Figure Out Their WHY:

You can’t help someone until you know why they need your help in the first place.

Fully understand their motivations for buying or selling. Are they a renter who wants to buy and start building equity? Are they an empty nester looking to downsize? Are they a growing family looking for more space?

Determine Their WHEN:

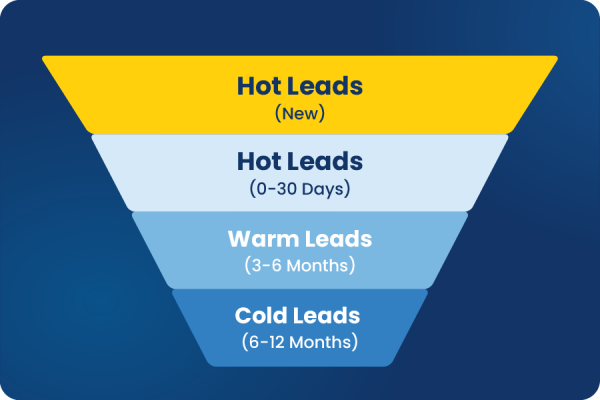

A lead’s timeline for buying or selling ultimately determines the next step in your follow-up strategy. You are essentially trying to see if they are “bottom of the funnel” leads ready to transact now, or “top of funnel” leads who will transact in the future.

If they are motivated and ready to go (bottom of the funnel), they are probably looking for frequent communication with information that moves them through the process. Talk to them about prequalification, set up property alerts, do a CMA, etc.

If they are planning to make a move in the next 3-12 months (or longer), they’re at the top of the funnel. They will likely want a little time and space without being pressured, and you’ll need to consistently provide long-term value to stay top-of-mind. Plans can change quickly, and you want to make sure they think of you when the time is right.

What to Say:

There are countless methods and frameworks out there for structuring your conversations with leads. By learning (and sticking to) one that works with your style, you set yourself up for a scalable, repeatable lead qualification process that is proven and effective.

Take the “LPMAMA” framework for buyer lead qualification, for example. This method includes questions designed to uncover relevant information about your leads while allowing you to build rapport and learn how to effectively help them.

L – Location: You already know the favorite real estate cliche, “location, location, location.” You want to determine where the lead wants to live and why they want to live there, along with certain areas they do not want to live. It allows you to assess how familiar they are with the desired neighborhood(s), which provides you with opportunities to validate and educate.

P – Price: Buyer leads typically have a good idea of where they want to live, but many might not have realistic expectations about the costs of living there. Don’t just start asking potentially sensitive questions about their finances. You’re still a stranger to them and need to build trust. Instead, simply ask if they have a budget in mind and provide information on average prices in their desired neighborhood.

M – Motivation: This is perhaps one of the most important parts of the conversation, but it can also be one of the more complicated parts at the same time. Again, you’re still a stranger to them and they might not be ready to get too personal. Plus, not all motivations are positive. They might be going through a tough situation that requires them to move, so don’t assume they are excited. Start with open-ended questions like:

• How long have you been considering a move?

• Do you have a specific timeframe?

• What are the most important things to you in a new home?

These questions avoid being overbearing while giving them chances to naturally tell you the real reason behind the move.

A – Agent: Determine if they’re already working with an agent. You might be tempted to ask this right up front to make sure you aren’t wasting valuable time trying to convert a lead that’s already working with someone, but don’t make this the immediate focus of the conversation. Many buyers will say they are working with an agent simply because they feel it will take the pressure off the conversation when it might not even be true. Take the time to build trust first. This helps get their guard down so they’re more likely to give you honest answers.

Ask about the lead’s previous experiences with agents, if any. This allows you to position yourself as the agent who can support them in the ways they want to be supported.

M – Mortgage: Like the “Price” step, you want to learn how prepared they are financially by asking if they’ve spoken with a lender. This provides an additional way to add value to the conversation by offering to send them a list of your trusted lenders. Not only can the lender help set realistic expectations on budget, but they can also help nurture the lead to help move them through the pipeline.

A – Appointment: The goal of your entire conversation should be to set an appointment, preferably in person. You want to provide a definitive next step. Summarize the conversation to reiterate the things

that are most important to them:

“I’m hearing you say… Do I have everything correct? Great! Our next step is to set up an appointment where you can come to my office and set a concrete plan for how we will achieve your goals. We can even preview a couple of homes if you have time. Do Thursdays or Saturdays work best?”

This is also the most likely time in the conversation where they’ll bring up any objections, so be sure you’re prepared.

Every conversation will be different, so let the conversation flow naturally and come from a place of curiosity, empathy, and education.

🚨 Pro-Tip 🚨 When they finally answer your call, do NOT immediately ask for the lead by name! Stay away from, "Hi, is this Stephanie?" – They will almost always say no. Assume you’re talking to the right person and simply introduce yourself and tell them why you’re calling.

📣 Download this Lead Intake Form to write down the most important details during your conversation.

Single property sites

Immediate download of

Ready-to-mail postcards

MLS Integration: Create

Automated Postcard

Automated Marketing

41% of members sell 20+

Focus on being a REALTOR®

The potential ROI of the

even more.

even more.

The best way to get started is to complete your profile

The best way to get started is to complete your profile